Just Turned 65? Learn How To Defer Medicare

At age 65, you can defer Medicare by delaying enrollment. If you are still working, you can delay retirement and avoid Part B and Part D late enrollment penalties.

Making Decisions About Retirement

At age 65, you or your working spouse will need to make a decision about retirement and the benefits that go along with it, if you haven’t already. If you’re celebrating this momentous birthday, you may be aware that you’re now eligible for Medicare, but you might not know all your options.

Americans born in 1929 or later can retire as early as age 62 with reduced Social Security benefits. However, to get full retirement benefits , you may choose to retire at age 66 or older, depending on your birthday.

It’s important to know how you can retire after age 65 or keep your health savings account and avoid paying Medicare late enrollment penalties.

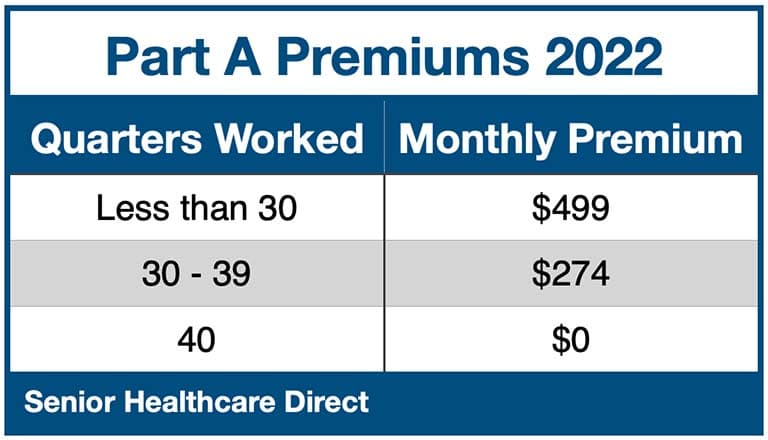

The Centers for Medicare and Medicaid Services (CMS) urges most people to enroll in premium-free Medicare Part A, even if they have health insurance from an employer. Part A will cover hospital care, while Part B covers outpatient care. You can choose to delay Part B enrollment if you have coverage elsewhere, but that could result in late enrollment fees.

It’s important to note that you’re able to sign up for Medicare coverage three months before the month of your 65th birthday. This lead time can help prevent the following penalties.

Medicare Part B Deferment Penalties

Part B late enrollment penalties accumulate the longer you defer enrollment. Specifically, your Part B premium goes up 10% for each 12-month period you could have had Part B but didn’t enroll.

If at some point you do choose to enroll in Medicare Part B, you’ll have to pay your Part B penalty every time you pay your premium.

Medicare Part D Deferment Penalties

Penalties for Medicare Part D depend on how long you were without creditable prescription drug coverage while you were eligible for Medicare drug coverage.

To calculate your penalty, multiply 1% of the “national-based beneficiary premium” ($33.37 in 2022) by the number of full, uncovered months you didn’t have Part D or creditable coverage. The result is rounded to the nearest $.10 and added to your monthly premium.

When To Delay Medicare Enrollment

Please consult with your employer or union benefits administrator before delaying Medicare enrollment. For instance, you may choose to defer Medicare until after age 65 to get more retirement benefits.

Should I Delay Medicare Enrollment If I’m Still Working?

Knowing how to defer Medicare without incurring a penalty is important if you’re still working past age 65. You can delay enrollment in Medicare Part B and avoid paying a late enrollment fee if you or your spouse has active health insurance from a current employer and that employer has at least 20 employees.

With this option, you’ll save on the Part B premium of $170.10 in 2022 for most Medicare beneficiaries, and you can postpone your one-time Medigap Open Enrollment Period so you can purchase this coverage later.

You’ll be able to sign up for Medicare Part B during an eight-month Special Election Period (SEP) anytime after your Initial Enrollment Period. If you enroll during SEP a whole month after your employer coverage ends, Medicare coverage will begin on the first day of the following month.

It’s recommended that you enroll in Part B before you stop working or your employer coverage ends to avoid a coverage gap. However, you only have two full months after the month your employer coverage ends to join a Medicare Advantage or Part D Prescription Drug Plan.

YM04152202