Medigap Plan N

Medigap Plan N pays the 20% coinsurance not covered by Medicare Parts A and B. Medicare Supplement Plan N is another name for Medigap Plan N.

Moreover, Medicare Plan N is a standardized plan with the same coverage benefits for all insurance carriers. In other words, all Medicare Insurance Companies who offer Plan N, such as Aetna, Mutual of Omaha, and UnitedHealthcare (AARP), provide you with the same coverage benefits.

Medicare Plan N Vs Plan G

Medicare Plan N has the same great coverage benefits as Medicare Plan G, except it requires you to make a copayment of up to $20 for some office visits. For example, a primary care doctor may charge you $8 to $12.

Furthermore, Medicare Supplement Plan N requires you to make up to $50 copayment for emergency room visits that do not result in an inpatient admission. In other words, if you go to the emergency room and get discharged without being admitted as an inpatient, you can pay up to a $50 copayment.

What Does Medigap Plan N Cover?

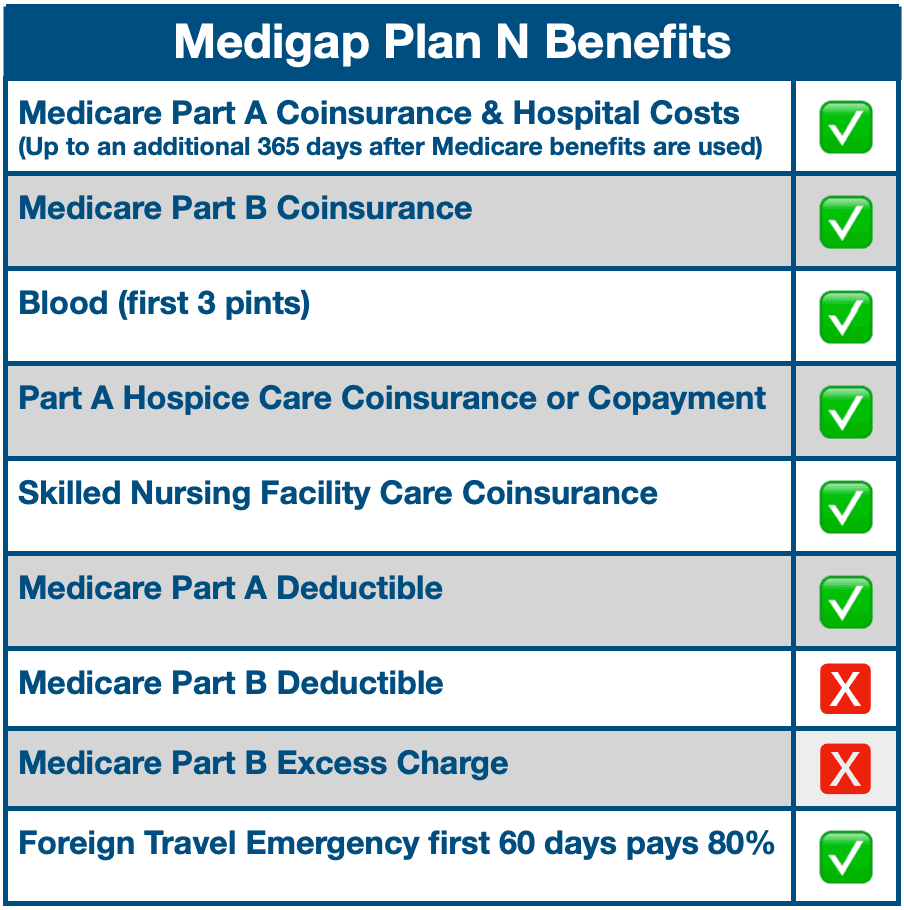

Plan N provides the same standard coverage benefits, no matter where you purchase the plan. In other words, Plan N has the same coverage regardless of which insurance company you choose. All Plan N policies include the following benefits:

Inpatient Hospital Coverage (Part A)

Outpatient Medical Coverage (Part B)

First 3 pints of blood

Skilled Nursing Facility Care

Foreign Travel Emergency

What Medigap Plan N Does Not Cover

As shown in the Medigap Plan N Benefits chart above, Plan N does not cover the Part B deductible, which is $226 in 2023. As a result, you first pay a $226 annual deductible before Medicare Part B covers your medical service or equipment. Furthermore, Plan N does not cover Medicare Part B excess charges. Consequently, any provider who does not accept Medicare assignment can charge you up to 15% more than the Medicare-approved price.

The Medigap Plan N Benefits chart does not show two instances where you make copayments.

For every outpatient doctor’s office visit, you may owe up to $20 copayment with Plan N.

When a doctor does not admit you as an inpatient, every visit to the emergency room will require you to pay up to $50 copayment with Plan N.

Medigap plans, including Plan N, do not cover prescription drugs. However, you can get prescription drug coverage by enrolling in Medicare Part D.

How Does Medicare Plan N Compare To Other Plans?

Medigap Plan N has the same coverage benefits as Plan D, except there are no copayments. When you step up to Plan D, you will not pay a $20 copayment for outpatient doctor visits, nor will you spend a $50 copayment for emergency room visits. Alternatively, you can step down to a more affordable Plan M, which only covers 50% of Part A Deductible. For example, if a doctor admits you to the hospital, you pay the first $800 (half of Part A deductible in 2023) before Medicare covers your hospital bills. You can use the Medigap Benefits Chart to compare all Medigap plans.

Who Is Eligible For Medicare Plan N?

To be eligible for any Medicare Supplement Plan, including Plan N, you must have Medicare Part A and Part B. If you have not signed up, discover how you can apply for Medicare. You can sign up for Medicare Part A and Part B during your 7-month Initial Enrollment Period. You are first eligible for Medicare when you turn age 65. However, if you did not sign up when you were first eligible, you can sign up during the General Enrollment Period between January 1 – March 31 each year.

Medicare Initial Enrollment Period

When you enroll in Medicare outside of your 7-month Initial Enrollment Period, Medicare Supplement insurance companies will ask you health questions. Moreover, Medigap insurance underwriting can deny coverage based on health conditions. Furthermore, the Medigap insurance provider may charge you more based on the underwriting interview. Thus, the best time to buy a Medigap plan is when you first become eligible.

Let Senior Healthcare Direct Help You Decide

What is Medicare Plan N? If you’re unsure about supplemental Plan N coverage and how it may fit with other coverage you have, let the experienced professionals at Senior Healthcare Direct provide the support you need. We can assess your current coverage and help you decide how Medicare Plan N coverage might work alongside what you have. Keep in mind that our team wants to ensure you get coverage that fits your goals — no matter what they are. Let us help you determine how you could benefit from Plan N coverage. We’ll help you find the right supplement plan for your situation.

YM06052301